I. Current Situation (Up to Early 2025)

- Significant Price Decline

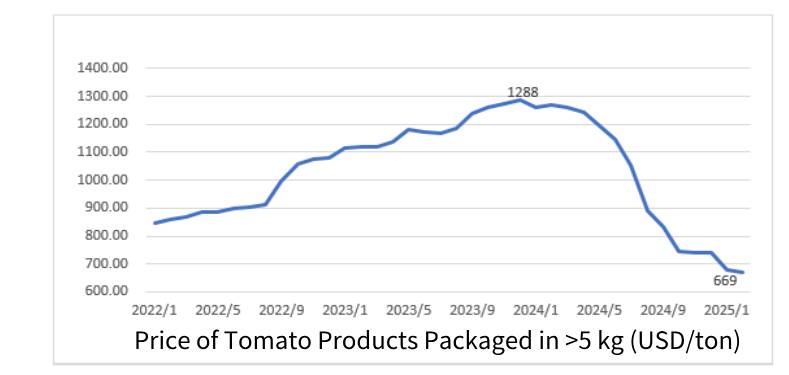

As shown in the chart, the export price of bulk packaged tomato paste (≥5kg) dropped from a peak of $1,288/ton in 2023 to $669/ton by early 2025, a decrease of nearly 50%. - Deteriorating Export Environment

- Global economic slowdown and weakening demand;

- Rising geopolitical risks, including the Russia-Ukraine war and Red Sea conflict, causing uncertainty in global trade;

- Excess supply globally: Global tomato processing volume is expected to reach 45.8 million tons in 2024, up 4% YoY and 20% compared to 2022.

China’s processing volume rose sharply to 11 million tons in 2024, a 37% YoY increase and 77% higher than 2022.

- Domestic Industry Pressure

- Over 80% of China’s tomato products rely on exports, making the industry highly vulnerable to external shocks;

- Massive overcapacity due to expansion after previous years’ price surge;

- Raw material prices remain rigid, causing a mismatch between production cost and market price;

- Financial stress has led some producers to offload inventory at low prices, further depressing the market.

Export Price Trend of Large-Pack Tomato Products (January 2022 – March 2025)

Data Source: China Customs

II. Forecast for 2025–2026

A. Short-Term Outlook: Weak Recovery Expected

| Factor | Assessment |

|---|---|

| Global oversupply | Inventories remain high through 2025 |

| Slow global demand | Demand recovery sluggish in key markets |

| Geopolitical instability | Continued uncertainty in logistics/trade |

| Domestic overcapacity | Intense price competition continues |

B. Mid-to-Long Term: Structural Opportunities Emerging

- European Weather Disruptions

- Early 2025 reports show droughts/floods in Spain, Italy, Greece, affecting yields;

- EU production shortfalls could create demand for Chinese exports in substitute markets;

- Non-brand-sensitive markets (Eastern Europe, MENA) may resume imports of Chinese tomato paste.

- Low Prices May Become a Competitive Edge

- With prices at a 5-year low, Chinese exports may regain competitiveness in bulk and food-service channels once global inventories ease.

- Industry Consolidation and Polarization

- Inefficient small players may exit the market;

- Scalable, vertically integrated producers will gain market share;

- Leading enterprises are pivoting toward value-added products (e.g., bottled sauce, flavoring pastes) and domestic retail markets.

III. Price Forecast (Indicative)

| Time Period | Estimated Export Price (USD/ton) | Market Trend |

|---|---|---|

| Q2–Q3 2025 | 650–750 | Market bottom, weak export recovery |

| Q4 2025–Q1 2026 | 750–880 | Modest rebound possible |

| Q2 2026 onward | 880–1,050 | Gradual recovery if global supply stabilizes |

IV. Strategic Recommendations for Chinese Exporters

- Stabilize Production & Control Costs

- Tighten cost control in farming and procurement;

- Avoid overexpansion amid weak margins.

- Tiered Market Strategy

- Focus export efforts on less brand-sensitive regions (Africa, Middle East, Eastern Europe);

- Shift domestic focus to foodservice, e-commerce, and value-added product lines.

- Risk Management

- Closely monitor FX rates, raw material volatility, and shipping risks;

- Secure advance orders or hedge against major cost fluctuations.

- Explore Diversification

- Consider expanding into concentrated paste in small packaging, sauces, or tomato-based health foods to increase value per unit.

- from